Fictional Product Expansion into the German Market

- Jess Portch

- Mar 16, 2022

- 7 min read

Updated: Nov 7, 2022

Established in 2016 after identifying a gap in the market for a high protein, low sugar chocolate bar, UnTouch is the industry pioneer representing strength and fearlessness. The rich chocolate bar made from 65% cocoa solids, premium whey protein isolate and 75% less sugar to satisfy the sweet tooth without the guilt. Positioned in the chocolate market, it promises to maximise muscle tissue growth and repair by providing 12g of protein per 35g serving. It is perfect for those who push the boundaries, dare to be different and strive for success. UnTouch has a share of 5% in the UK chocolate market (due to its specific target segment) and as part of an international expansion strategy, the brand is expanding into the German market from the United Kingdom (UK), as discussed further below.

Reasons for the Choice of Country

The UK sold 2.2 kilograms of chocolate per capita in 2020 (Defra, 2022), whereas Germany sold 5.65 kilograms and is set to sell 6.33 kilograms by 2025 (Statista Consumer Market Outlook, 2020). This shows that Germany has a high and growing demand for chocolate products, implying that UnTouch will sell more products there than in the UK, thus being a logical market to expand into. Furthermore, Germany is the second largest importer of chocolate globally, with a trade value of $2.42 billion (UN Comtrade, 2021), suggesting that it would be likely to import UnTouch from the UK. Despite this, Germans like to eat healthy with 61.5% eating a healthy and balanced diet very often (Kitchen Stories, 2019). 76% of Germans are also sports nutrition users, with the majority consuming these products multiple times a week (Statista – Consumer and Business Insights, 2021). Additionally, Germany is the largest national fitness market in Europe with a revenue of €5.3 billion (Rutgers, et al., 2019). This shows that Germans like to be healthy but also consume chocolate, which is typically an unhealthy product, therefore, UnTouch is well-suited for the German market because it meets their nutritional needs while satisfying their chocolate cravings. Germany also has high long-term orientation meaning that they are adapt easily from traditions and persevere for their achievements (Hofstede Insights, 2022). This implies that German consumers may be likely to adapt to UnTouch as a new source of protein and use it to achieve their health and fitness goals.

Product and Brand: Product Model, Brand, and Brand Identity

Product

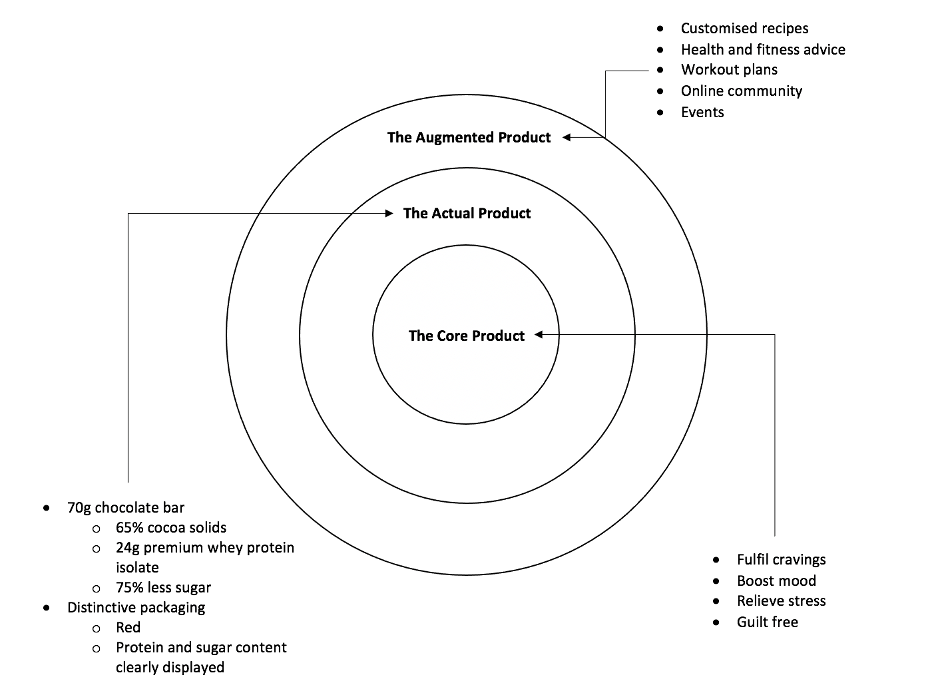

A product’s design determines its success in the market (Bloch, 1995). Kotler (2017) proposes three levels to a product, the core, actual and augmented, each adding value for the customer and are essential in the design stage. The design of UnTouch is, therefore, considered in depth below through, application of Kotler’s (2017) The Augmented Product (below).

Considering the actual product level, UnTouch’s high protein, low sugar content is the key differentiating factor amongst competitors in the German chocolate industry. It provides competitive advantage because it offers these unique sets of tangible benefits that no competitor does, thus generating increased customer value (Porter, 2011). Furthermore, UnTouch has the product’s unique high protein, low sugar content clearly advertised on its red packaging. This distinguishes it from Germany’s leading chocolate brands, such as Milka, Ritter Sport and Lindt (VuMA, 2020) (see appendix 1), and increases consumer engagement with UnTouch, pushing them further down the decision making process to purchasing the product (Bloch, 1995). Kotler (2017) posits that the augmented product level enables further competitive advantage by providing a positive brand experience. UnTouch offers post-sale services such as, health and fitness advice, recipes and access to the online community by scanning a quick response (QR) code inside the packaging. These are difficult for competitors to copy, further differentiating the product and thus adding value for the customer (Godson, 2009).

Brand

Competitive advantage can also derive from branding, which can be split into four elements of brand associations and provides a deeper understanding of a brand (Perrey & Spillecke, 2013). Applying Perrey and Spillecke’s (2013) Brand Diamond, the branding on UnTouch is considered in depth below (below).

Perrey and Spillecke (2013) suggest that emotional benefits allow self-expression and reinforce self-concept. This can evoke positive feelings that deepen the brand experience for the consumer (Aaker, 2012). UnTouch, a shortened version of the word ‘untouchable’, implies that the customer is superior in terms of fitness and strength, increasing confidence and self-esteem, and directly linking to the feeling the brand creates. Furthermore, it is likely that consumers will purchase UnTouch to achieve their health and fitness goals, thus aligning with their ideal selves (Astakhova, Swimberghe, & Wooldridge, 2017). Tangible attributes, such as brand identity, further differentiates the brand from competitors (Edge & Milligan, 2009). UnTouch’s identity contrasts to its competitors (see appendix 1) as they may be perceived as friendly and indulgent, whereas UnTouch represents strength and power, thus providing distinctiveness.

Segmentation, Targeting and Positioning

Segmentation and Targeting

Dibb (1998) proposes that segmenting the market provides an understanding of consumers’ needs and wants, therefore, improving a company’s ability to target consumers with a suitable product. Additionally, consumers are suggested to prefer brands with a personality that reflect their own (Huang, Mitchell, & Rosenaum-Elliott, 2012), hence why UnTouch is aligned with specific consumer segments. Companies may also vary in competitiveness in regard to specific segments (McDonald, Christopher, & Bass, 2003), implying that by identifying an untargeted segment may increase its competitive advantage. UnTouch implements this by targeting health and fitness conscious consumers. Finally, in relation to food, Grunert, Brunsø and Bisp (1997) advise to use a product’s benefits to segment the market, as depicted in Figure 3 utilising UnTouch’s health benefits.

Consumers prefer brands with a personality that reflects their own (Huang, Mitchell, & Rosenaum-Elliott, 2012), therefore, Fitness Fanatic Millennials’ obsession with health and fitness, and their need for achievement can be utilised so UnTouch becomes their favoured chocolate brand. They are also easily influenced by peers and social media bloggers, suggesting that targeting them through an influencer marketing strategy could further drive sales (Grafström, Jakobsson, & Wiede, 2018). An undifferentiated marketing strategy should, therefore, be implemented because UnTouch is going into one market and offering everyone the same product (Kotler, Armstrong, & Opresnik, 2021).

Positioning

A product’s positioning is determined by consumers’ perceptions in comparison to competition, therefore, it is important for companies to establish their value proposition to ensure their perceptions are what the company intends (Kotler, Armstrong, & Opresnik, 2021). Furthermore, this may provide competitive advantage if the positioning is differentiated away from its competitors (Seamans & Zhu, 2012). Figure 4 applies this to UnTouch.

A brand’s positioning should meet the needs and wants of the target segments (Kotler, Armstrong, & Opresnik, 2021). As shown above, the targeted segments are health conscious and fitness enthusiasts hence why UnTouch is positioned as healthy (75% less sugar) and innovative (high protein). As Figure 4 demonstrates, no competitor is similarly positioned which implies UnTouch has distinguished itself in the market thus achieving the competitive advantage.

Conclusion

Germany’s forecasted increasing chocolate consumption, their desire for a healthy diet and large import trade value, coupled with the Fitness Fanatic Millennials’ passion for health, fitness and its products makes it an attractive market for a nutritional chocolate bar to expand into. It is important for UnTouch to focus branding on its emotional benefits of providing a sense of achievement, feeling stronger and increasing self-esteem as this aligns with the target segments’ behavioural characteristics thus potentially creating favouritism of UnTouch amongst this group. Furthermore, being nutritional and designed for muscle growth makes UnTouch unique in the chocolate market allowing it to gain competitive advantage, however, it must ensure to promote the intangible attributes to increase the difficulty of competitors copying.

Sources

Aaker, D. A. (2012). Building Strong Brands. Simon and Schuster.

Arenas-Jal, M., Suñé-Negre, J. M., Pérez-Lozano, P., & García-Montoya, E. (2019). Trends in the Food and Sports Nutrition Industry: A Review. Critical Reviews in Food Science and Nutrition. Critical Reviews in Food Science and Nutrition, 60(14), 2405-2421. https://doi.org/10.1080/10408398.2019.1643287

Astakhova, M., Swimberghe, K. R., & Wooldridge, B. (2017). Actual and Ideal-self Congruence and Dual Brand Passion. The Journal of Consumer Marketing, 34(7), 664-672. https://doi.org/10.1108/JCM-10-2016-1985

Bloch, P. H. (1995, July 1). Seeking the Ideal Form: Product Design and Consumer Response. Journal of Marketing, 59(3), 16-29. https://doi.org/10.2307/1252116

Defra. (2022). Average purchase volume per person per week of confectionery in the United Kingdom (UK) from 2006 to 2019/20, by type (in grams). Defra. Retrieved Febuary 2022 from, Statista: https://www-statista-com.hallam.idm.oclc.org/statistics/711734/weekly-household-purchase-of-confectionery-in-the-united-kingdom-uk/

Dibb, S. (1998). Market Segmentation: Strategies for Success. Marketing Intelligence & Planning, 16(7), 394-406. https://doi.org/10.1108/02634509810244390

DuStatis. (2021). Number of Students in Universities in Germany During Winter Semesters from 2002/2003 to 2020/2021 (in millions). Statistisches Bundesamt. Retrieved Febuary 2022 from, Statista: https://www-statista-com.hallam.idm.oclc.org/statistics/584061/university-student-numbers-winter-semesters-germany/

Edge, J., & Milligan, A. (2009). Don't Mess with the Logo: The Straight Talker's Bible of Branding. Pearson Education.

Euromonitor International. (2016). Global Trends in Protein.

Euromonitor International. (2017). Consumer Lifestyles in 2017: Global Survey Results.

Euromonitor International. (2021). Voice of The Consumer: Lifestyle Survey .

Ferrero. (2022). Home. Retrieved Febuary 2022, from Ferrero: https://www.ferrero.co.uk/

Godson, M. (2009). Relationship Marketing. Oxford: Oxford University Press.

Grafström, J., Jakobsson, L., & Wiede, P. (2018). The Impact of Influencer Marketing on Consumers' Attitudes. Jonkoping University International Business School.

Grunert, K. G., Brunsø, K., & Bisp, S. (1993). Food-Related Life Style: Development of a Cross-Culturally Valid Instrument for Market Surveillance. Denmark: MAPP.

Hoffower, H. (2021, September 18). Move Over Millennials, Gen Z is the New 'it' Generation. Retrieved Febuary 2022, from Business Insider: https://www.businessinsider.com/millennials-versus-gen-z-it-generation-cool-fashion-trends-pandemic-2021-9?r=US&IR=T

Hofstede Insights. (2022). Country Comparison. Retrieved Febuary 2022, from Hofstede Insights: https://www.hofstede-insights.com/country-comparison/germany,the-uk/

Huang, H., Mitchell, V., & Rosenaum-Elliott, R. (2012). Are Consumer and Brand Personalities the Same? Psychology & Marketing, 29(5), 334-349. https://doi.org/10.1002/mar.20525

IfD Allensbach. (2020). Living Situations in Germany in 2020, by age group. Retrieved Febuary 2022, from Statista: https://www-statista-com.hallam.idm.oclc.org/statistics/974222/living-situations-age-group-germany/

Katjes. (2022). Company. Retrieved Febuary 2022, from Katjes: https://www.katjes.com/company

Kitchen Stories. (2019). Individuals following a healthy and balanced diet in Germany 2019, by frequency. Statista.

Kinder. (2022). Home. Retrieved Febuary 2022, from Kinder: https://www.kinder.com/uk/en/

Kotler, P. (2017). Principles of Marketing. Upper Saddle River: Pearson.

Kotler, P., Armstrong, G., & Opresnik, M. (2021). Principles of Marketing. Harlow: Pearson.

Lantos, G. (2014). Marketing to Millennials:Reach the Largest and Most Influential Generation of Consumers Ever. Journal of Consumer Marketing. https://doi.org/10.1108/JCM-03-2014-0909

Lindt. (2022). Home. Retrieved Febuary 2022, from Lindt: https://www.lindt.co.uk/world-of-lindt

MarketLine. (2017). Millennial Consumers: Understanding Key Trends Driving Consumer Behaviours. MarketLine.

Comments